Bitcoin Price Forecast: BTC momentum fades, edging below $115,000 despite Putin-Zelenskyy meeting on the cards

- Bitcoin price continues to trade in red on Tuesday after falling nearly 5% from its record high of $124,474 set last week.

- US President Donald Trump called President Putin to arrange trilateral talks with the Russian leader and Ukrainian President Zelenskyy.

- Despite the weakness in the BTC price, treasury companies such as Metaplanet and Strategy remain comfortable buying at these levels.

Bitcoin (BTC) continues to lose steam, slipping below $115,000 at the time of writing on Tuesday, after retreating nearly 5% from last week’s record high of $124,474. The decline comes as markets turn cautious ahead of geopolitical developments, with US President Donald Trump confirming to arrange trilateral talks with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy. Despite the price weakness, treasury firms like Metaplanet and Strategy continue to accumulate BTC at current price dips.

Trump to arrange a trilateral meeting between Russia and Ukraine

Ukrainian President Zelenskyy and several European leaders met with US President Trump at the White House on Monday for fresh talks aimed at ending the war in Ukraine. This comes after the summit in Alaska on Friday, in which Trump met with Russian President Putin.

The key takeaway of Monday’s meeting was that Donald Trump is set to arrange trilateral talks with the Russian leader and Zelenskyy. This raises hopes for a breakthrough towards ending the protracted Russia-Ukraine war and could help risk-on sentiment, which could boost investors’ confidence and rally in cryptocurrencies such as Bitcoin.

Apart from the trilateral talks, the US would help guarantee Ukraine’s security, Trump said. It is not clear what form those would take, with possibilities including foreign troops deployed on the ground, joint air and sea patrols, intelligence sharing or logistical support.

Bitcoin’s treasury companies buy BTC dips

Bitcoin price continues to trade below $115,000 on Tuesday, having fallen nearly 6% from its recent record high of $124,474. Despite this price pullback, treasury companies such as Metaplanet and Strategy had added a total of 1,185 BTC on Monday, comfortably buying at these price dips.

QCP Capital reported on Monday that implied volatility is still relatively low, and the market does not expect a major breakout.

“Sideways trade seems likely, with dips near 112,000 attracting buyers and rallies toward 120,000 meeting supply, at least until Friday when Fed Chair Jerome Powell takes the stage”, reported QCP analyst.

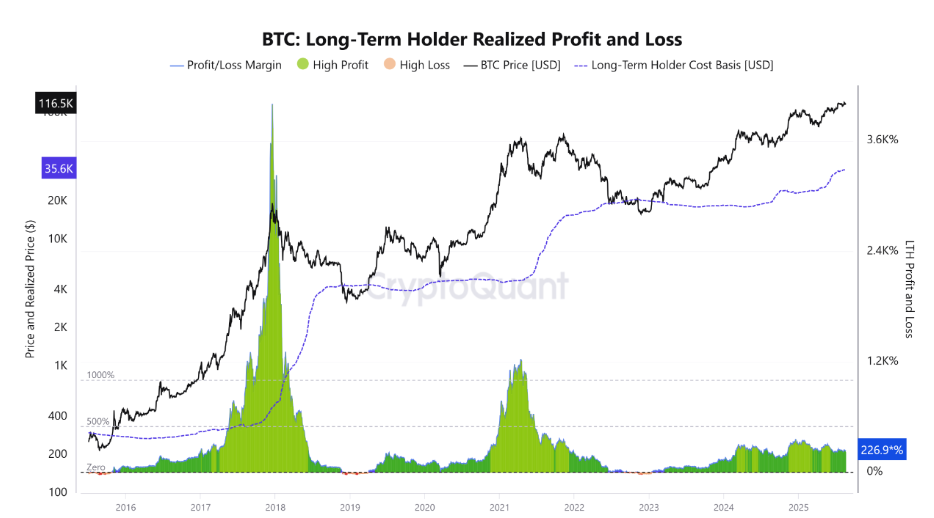

CryptoQuant Long-Term Holder (LTHs) Realized Profit and Loss data indicate that the metric’s current levels are green and remain moderate, suggesting that LTHs are realizing gains, albeit not as aggressively as in previous peaks seen during 2017, 2018–2019 and 2022–2023 bull markets. This suggests that BTC is trading near its all-time high, yet selling pressure is controlled and still has room for further upside.

BTC LTH Realized Profit and Loss chart. Source: CryptoQuant

Some signs of concern

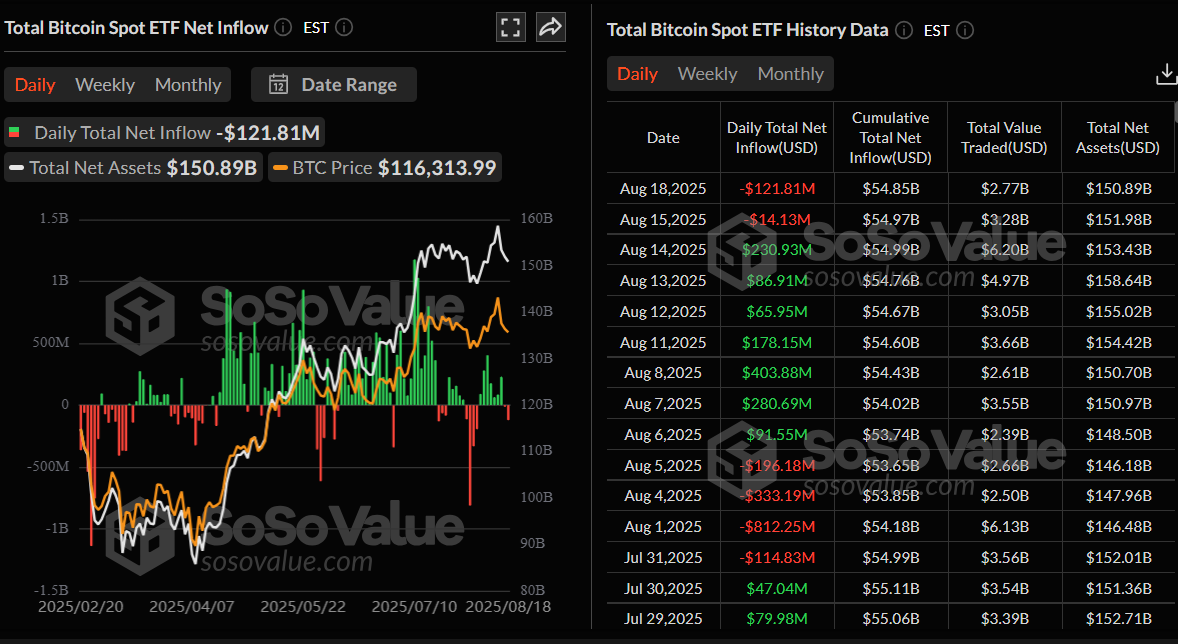

SoSoValue data shows that institutional investors recorded a mild outflow of $121.81 million on Monday, continuing their second-day of outflows. If these outflows continue and intensify, the BTC price could face further correction.

Total Bitcoin Spot ETF Net Inflow chart. Source: SoSoValue

Bitcoin Price Forecast: BTC momentum indicators show weakness

Bitcoin price reached a new all-time high of $124,474 on Thursday but failed to maintain its upward strength and declined 4% on the same day. BTC hovered around the $117,300 level during the weekend. On Monday, BTC extended the decline, closing below $116,300. At the time of writing on Tuesday, it continues to trade down, falling below an ascending trendline drawn by connecting multiple lows since early April.

If BTC closes below its 50-day Exponential Moving Average (EMA) at $115,046 and the ascending trendline on a daily basis, it could extend losses toward its next support level at $111,980.

The Relative Strength Index (RSI) reads 44 on the daily chart, below its neutral level of 50, indicating bearish momentum. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Sunday, giving a sell signal and suggesting a downward trend ahead.

BTC/USDT daily chart

However, if BTC finds support around the 50-day EMA at $115,046 and closes above the daily level of $116,000, it could extend the recovery toward its psychological level of $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.